One of the cornerstones of the Senate coronavirus stimulus package is the direct payment of money from the federal government to American individuals and families.

In the middle of the bill’s hundreds of pages are details regarding exactly who can expect to receive money and how much they can expect. Here is a breakdown.

Who is eligible?

The bill makes clear that everyone is eligible except for nonresident aliens and those who can be used as the basis for deductions for another person.

“Seniors, veterans, the unemployed and low-income Americans would be eligible too,” Senate Finance Committee Chairman Chuck Grassley said Wednesday.

The bill text indicates those who receive social security can collect checks: For those not required to file 2018 or 2019 tax returns because of social security benefits, tax returns aren’t required to claim the money — the government can use information from a Form SSA-1099, Social Security Benefit Statement, or Form RRB-1099, Social Security Equivalent Benefit Statement.

With that in mind, here is how much people can expect to get.

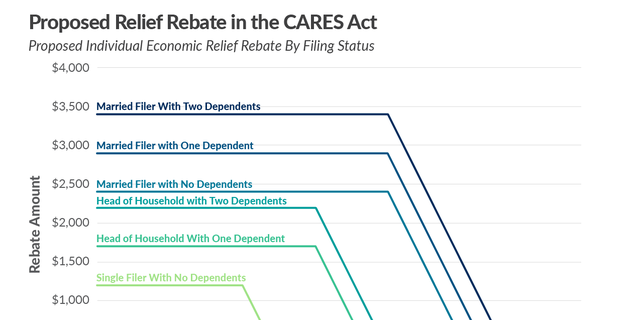

People filing individually

People who file their taxes as individuals are eligible for payments up to $1,200, but that decreases for people who earn more than $75,000 a year. The bill says that the payment is reduced by five percent of every dollar above that mark, or $50 for every $1,000 above $75,000.

What that ultimately means is that for people who make more than $75,000 the payment is less the higher their earnings are, with it being reduced to zero for those who make $99,000 or more.

People filing jointly

Couples who file a joint tax return are eligible for a payment of up to $2,400, plus and additional $500 per child. However, that amount decreases for couples who earn more than $150,000 in a year at the same rate of 5 percent of every dollar above that mark.

This translates to less money the more people make, with it being reduced to zero for joint filers without children who earn $198,000 or more.

People filing as heads of households

People who file as heads of households are eligible for payments of up to $1,200, but that amount is increased by $500 per child. That amount is reduced for people who earn more than $112,000 a year. The extent to which it is decreased, of course, depends on how many children they have, as illustrated by the chart above.

The following chart, courtesy of the Tax Foundation, illustrates how it all works.

Income is based on people’s tax filings for 2019, but they have not filed for that year, then their filing for 2018 applies.

“[I]f the individual has not filed a tax return for such individual’s first taxable year beginning in 2018,” the bill says, the information should be used for 2019 provided in their SSA-1099 or RRB-1099 Social Security Benefit Statements.

When and how are payments made?

Payments, according to the bill, will be made “as rapidly as possible” and no later than Dec. 31, 2020. They will be made via direct deposit to an account that the person has authorized for tax refunds or federal payments on or after Jan. 1, 2018.

Notice will be sent to the person’s last known address within 15 days of payment informing them of the method and amount of payment. A phone number will also be provided so people can call the IRS in the event they did not receive it.